Submission Intake

Streamline Your Submission Intake with Roots AI

Use AI to automate data extraction, document classification, and compliance checks, reducing errors and speeding up underwriting processes. Adopting AI can increase your teams capacity by 3-5x without adding headcount to boost efficiency and lower operational costs.

Top Insurance Companies Trust Roots

Streamline your submission intake process with Roots’ AI Agents to significantly reduce data extraction and clearance times for faster turnaround on new business opportunities. Give your underwriting team the competitive edge they need for responding to more submissions and quoting more deals.

Leverage Roots’ AI Agents to automatically check for uninsurable risks, ensure compliance with business rules, and classify risks with precision. This results in fewer errors, greater consistency, and enhanced risk assessment — all while adhering to regulatory standards.

Boost your underwriting team's capacity by 3-5x with Roots’ AI Agents, allowing your team to handle end of quarter peak demand without increasing headcount. This helps manage growing submission volumes while keeping operational costs low.

CHALLENGE

Slow, error-prone manual submission intake delays quoting and frustrates brokers, causing lost business.

Underwriting teams struggle with an overwhelming number of submissions, filled with unstructured data trapped in loss runs and other complex documents. Manual work to sort through this information is error-prone, slowing quote generation, reducing quoting opportunities, and ultimately impacting premium revenue generation.

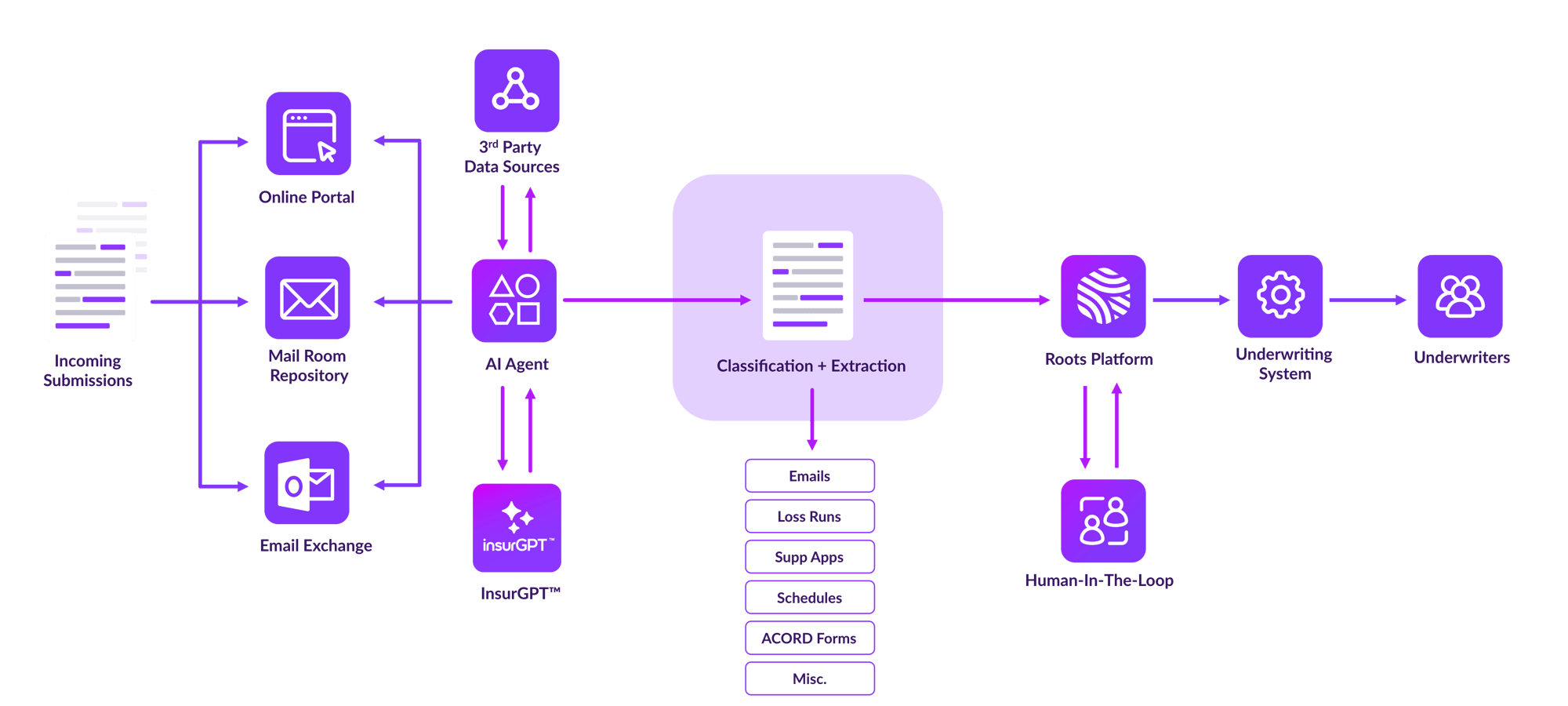

Automate Submission Intake for Faster, Error-Free Underwriting

Roots’ Submission Intake AI Agent automates the process end-to-end. It quickly and efficiently monitors submission channels, classifies ACORD forms and other documents, extracts key data from loss runs, and requests missing information from brokers. With faster data intake and processing, underwriting teams can respond faster, reduce errors, and handle higher submission volumes with ease.

Insurance AI Agents Support Across Business Lines

Video

In just 2 minutes, discover how our AI Agent can simplify your submission intake process.

How It Works

How AI Agent Driven Submission Intake Works

Monitor

Watch email inboxes, mailroom output, or broker systems for new submissions

Classify

Ingest, analyze, classify, and index applications, statements of value, loss runs and broker letters

Extract

Identify all the crucial data points like coverage requests, previous policy number, loss amounts paid, and dates of previous claims

Data Input

Deliver data automatically to appropriate raters and quoting systems

Assign to Teams

Assigns submissions to the relevant underwriting resource/team based on predefined rules

Review Submission Completeness

Review submission requests to identify missing elements and request them from brokers

Check for Market Reservation and Sanctions

Identify insured parties and lines of business for market reservation and sanction lists checks

Augment with 3rd Party Data

Add data from a third parties and in-house systems to support assessment

Open New Accounts

Streamline new accounts opening and populate with required data points

BENEFITS

Revolutionize Submission Intake with Roots: Automate, Scale, and Optimize for Maximum Efficiency and ROI

- Reduce submission setup times automate data extraction and cut submission setup and clearance time by 80%.

- Ensure compliance and consistency by reading ACORD forms, checking for uninsurable risks based on predefined business rules, and classifying risks and matching them to predefined thresholds.

- Increase overall capacity by scaling underwriting team capacity by 3-5x to better handle demand peaks.

- Lower operational costs and achieve faster, more accurate processing without adding extensive internal capabilities or centers of excellence, reducing overall operational expenses.

- Reduce employee burnout and eliminate manual tasks and automate repetitive, error-prone tasks.

- Drive up to 250% ROI quickly with pre-trained AI Agents ready on day one, without heavy investment in data, IT, or infrastructure.

- Reduce time-to-quote cycles to win more business.

- Generate more premiums by increasing the accuracy of the data required to price and assess risk.