CLAIMS AUTOMATION

Reduce Claims Leakage, Resolve Claims Faster, & Delight Policyholders

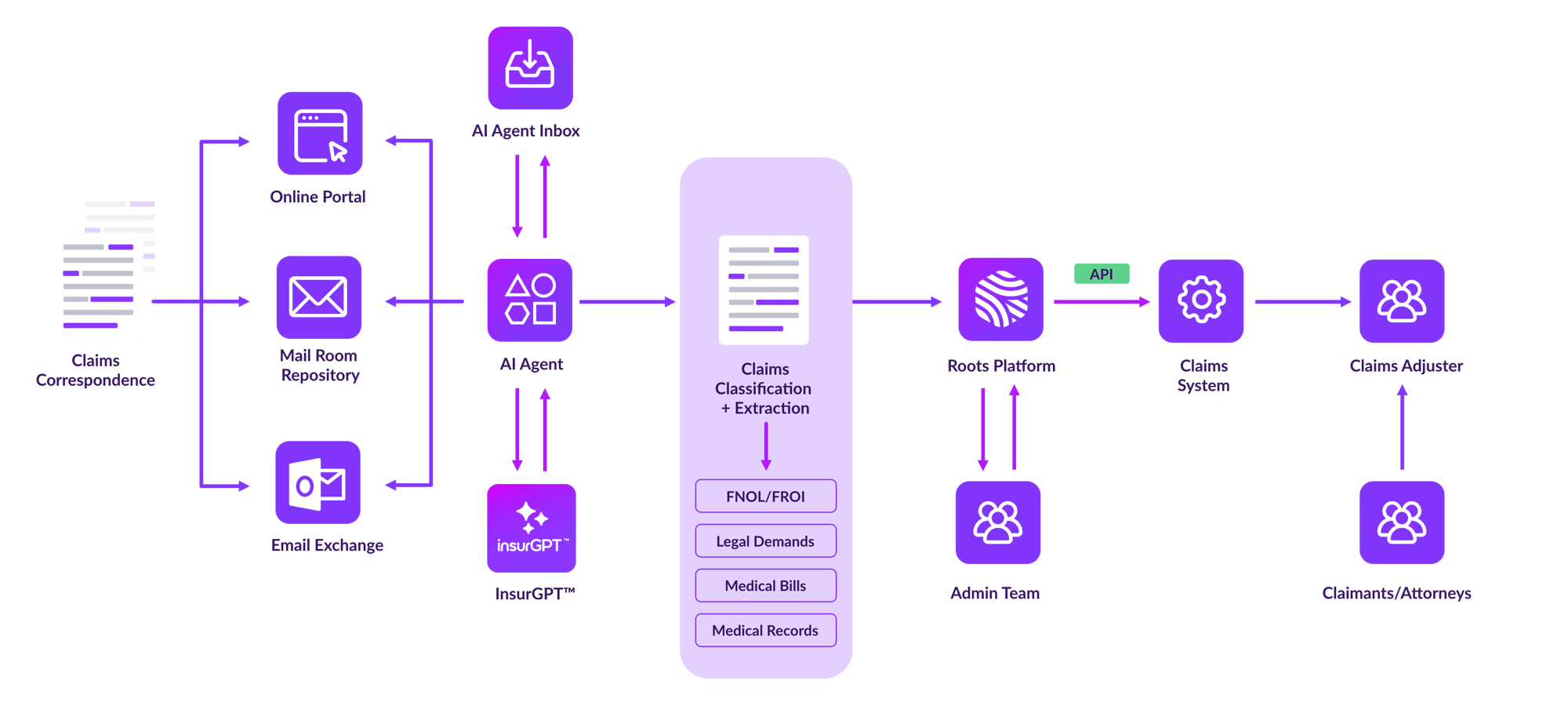

Let Roots AI Agents automate the manual and time-consuming processes that adjusters face daily, reducing costs and improving operational efficiency, speed, accuracy, the customer claims experience.

Top Insurance Companies Trust Roots

Roots AI Agents work 24x7 to reduce manual effort, delivering 98% accuracy across a broad range of data capture and classification tasks. Their capabilities include lightning-fast claims indexing and FNOL request processing, automating triage assignment, and reserve setting procedures to expedite claims initiation for faster response times. And our AI Agents do all this while expanding capacity for your claims experts to devote personal attention to complex claims management, adjudication, and customer engagement.

Roots AI Agents categorize over 50 different types of claims documents with 98+% accuracy and consistency. Built with Roots' InsurGPT™, the world's most advanced generative AI model for insurance, they accurately extract critical information from structured and unstructured documents, including claimant name, policy number, claim amount, and cause for claim. Automating data extraction and entry lets adjusters access greater quantities of accurate data and insights supporting more effective claims management, informed decision-making, and faster claims resolution.

Roots AI Agents process 99+% of FNOL requests straight through and automates other claims-related procedures to reduce manual effort, administrative costs, and dependency on BPO. Delivering precise, accurate claims data gives adjusters the information needed to reduce overpayment with more accurate decision-making.

AI Claims Process Automation = Happy Customers & a Better Combined Ratio

Challenge

Large volumes of highly variable claims documents break service-level agreements (SLA ), frustrating adjusters and causing significant delays

Claims teams regularly battle huge volumes of multi-channel submissions. Manual work extracting data from these documents is error-prone, causing costly delays, frustrated adjusters and claimants, and potential claim overpayments. These problems only intensify during peak-demand times, like CAT season. Roots AI Agents deliver a superior solution for streamlining complex processes to improve claims management across the entire process.

Insurance AI Agents Support Across Business Lines

BENEFITS

See How Roots AI Agents Power Your Claims Team's Success

- Reduce claims leakage by collecting more accurate, error-free claims data and consistently applying your claim processing rules to reduce overpayments.

- Cut costs by automating routine classification and data extraction tasks to reduce manual labor and reliance on third parties for document management.

- Enhance precision to reduce errors in the classification, data extraction, and data entry processes with 98%+ accuracy.

- Improve straight-through-processing rates by minimizing manual document handling.

- Improve efficiency and capacity, reducing document classification times by 90+% and expanding team capacity to ensure 24x7x365 productivity.

- Improve prioritization instantly to identify and expedite the processing of documents with specific demands and specialized assignment rules.

- Eliminate duplicate document reviews and find documents that have been previously captured and/or don’t need to be analyzed.

- Increase customer satisfaction by delivering faster claims handling and payment.