Underwriting Automation

Automate Tasks, Accelerate Quotes, Boost Capacity & Revenue

Overcome underwriting bottlenecks. Let Roots AI Agents automate tedious data tasks, boosting team capacity to deliver lightning-fast quote times that delight brokers and increase premiums revenue.

Top Insurance Companies Trust Roots

Roots reduces underwriting submission setup and clearance times by 80%, freeing underwriters from manual data entry and allowing them to focus on crucial risk assessment, resulting in increased job satisfaction and a better work-life balance.

With Roots AI Agents, you can dramatically accelerate quote cycle times by automating data extraction and system input across submission documents. Faster quote delivery improves quote-to-bind ratios, which leads to more policies and higher premium revenue. Enhanced data accuracy ensures better quote precision and optimal premium pricing for increased profitability.

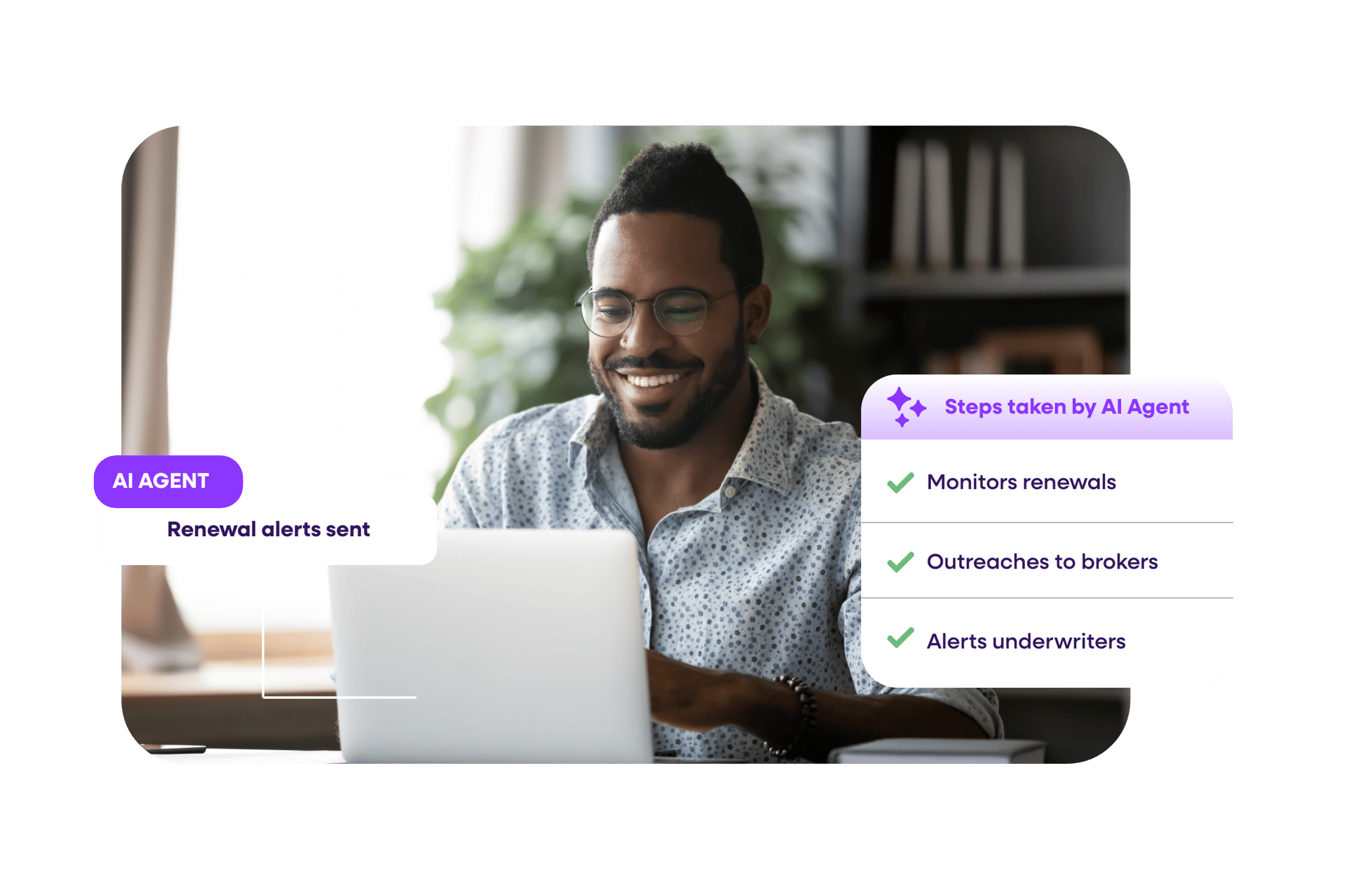

Increase broker satisfaction and loyalty with Roots’ AI-powered automation, which allows for better communication and faster responses. Thrill brokers and agents with rapid turnaround times, to strengthen relationships and win more business.

CHALLENGE

Capacity issues cause slow quote times, clearance team backlogs, and endless back-and-forth with brokers.

Consider a world where your clearance and underwriting teams are free from repetitive data extraction, data entry, and administrative tasks.

Now imagine your underwriting process revolutionized with a Roots AI Agent that can automate tedious tasks, increase team efficiency, provide unsurpassed data quality, and even boost premium income by quoting more business faster.

Optimize Risk, Pricing, and Broker Satisfaction with Lightning-Fast Quotes

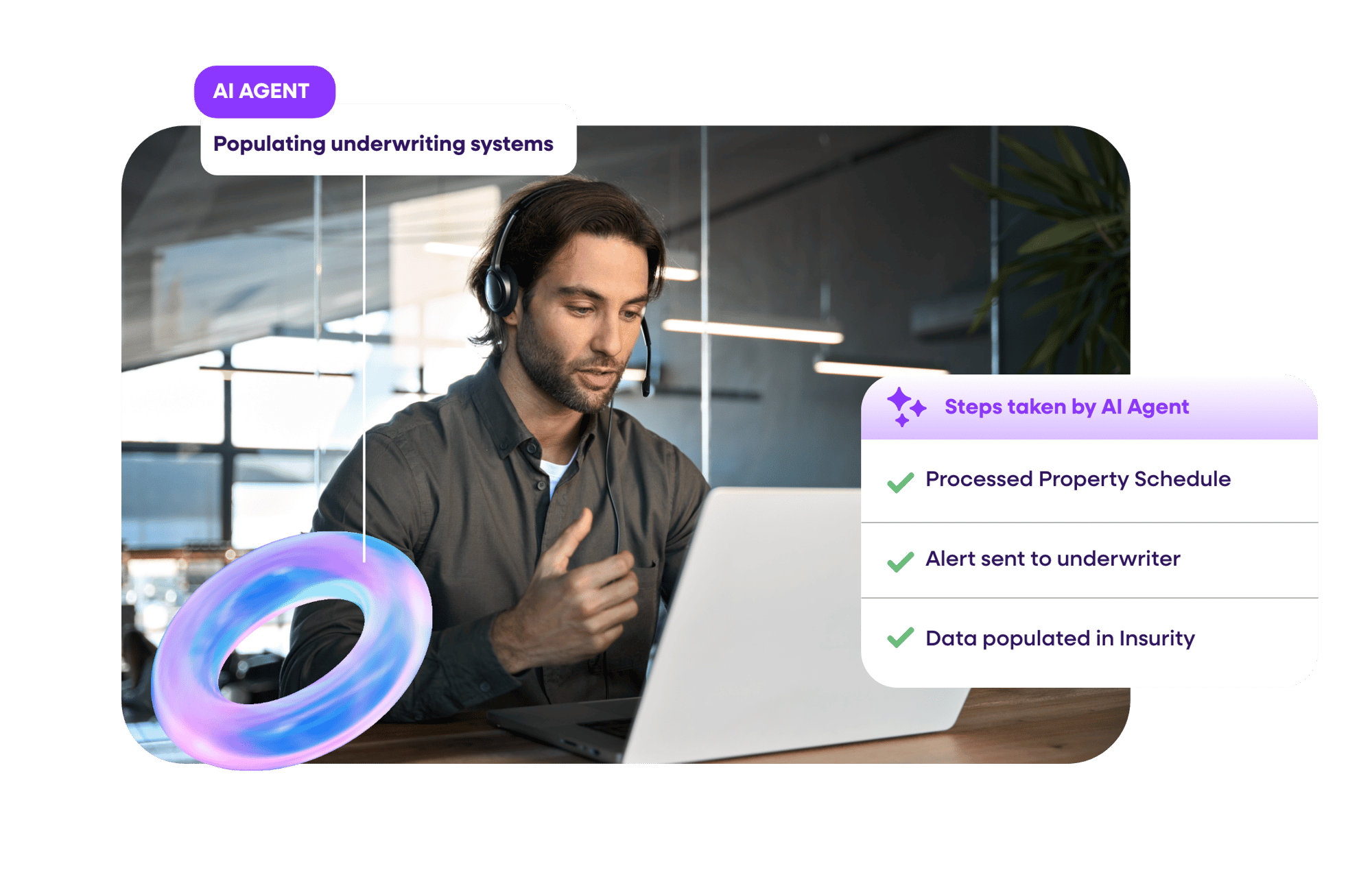

With Roots AI Agents on the job, you can confidently quote with a complete view of risk, optimize pricing, and delight brokers with lightning-fast turnaround times. Our underwriting AI Agents efficiently manage data ingestion, classification, and extraction from emails/attachments, applications, loss runs, ACORD forms, and a wide range of other unstructured documents. The result is faster quote cycle times and higher quote-to-bind ratios--and more time for your underwriters to focus on risk appetite and price optimization decisions.

Video

In under 3 minutes, learn how underwriting automation can streamline tasks, accelerate quotes, and boost capacity and revenue.

Insurance AI Agents Support Across Business Lines

BENEFITS

Revolutionize Your Underwriting Process with Roots' AI-Powered Workforce

- Streamline underwriting by cutting submission setup and clearance time by 80%.

- Accelerate quote cycle times by automating data extraction and input into systems.

- Reduce premium leakage with 10x more data surfaced from documents to improve overall underwriting accuracy.

- Improve quote-to-bind ratios driving more policies and increased premium revenue.

- Increase broker satisfaction and loyalty with better communication and faster responses to agents, increasing the likelihood of winning more business.

- Cut operational costs by automating data extraction and population into your core systems.

- Free up underwriters to focus on risk assessment and decision-making by eliminating manual data input.

- Improve employee satisfaction by getting them home for their kid's soccer match.