Loss Run Processing

Access Loss History Data and Insights Faster

Increase efficiency, cut costs and empower more responsive underwriting decision-making with a Roots AI Agent automating loss run data extraction and entry into your systems.

Top Insurance Companies Trust Roots

Process loss run reports 90% faster with 98% accuracy, giving your underwriters more time (and better data) for risk critical risk-assessment activities.

Roots' AI Loss Run Agent delivers 98% data extraction accuracy, reducing quote cycle time and boosting underwriting and clearance team capacity to smooth demand peaks.

Take control of your loss run processing and your underwriting date pipeline to significantly cut costs and reduce reliance on Business Process Outsourcers (BPOs).

CHALLENGE

Losing business to your competitors because of slow, inefficient loss run processing.

Extracting detailed exposure and loss histories from a mix of structured and unstructured data is a challenging task, especially given carriers' unique document formats. Manual processing or reliance on BPOs to supply accurate data slows the process, causing longer quote times and missed business opportunities.

Get Instant Loss Run Data & Faster Quotes

Streamline risk assessment data acquisition, accelerate quote times, and improve job satisfaction for underwriting and clearance team members.

Roots delivers instant access to loss run data to for quicker quotes and happier customers. Our Loss Run AI Agent is built and trained to process loss run reports 90% faster and 98% more accurately than manual methods.

Insurance AI Agents Support Across Business Lines

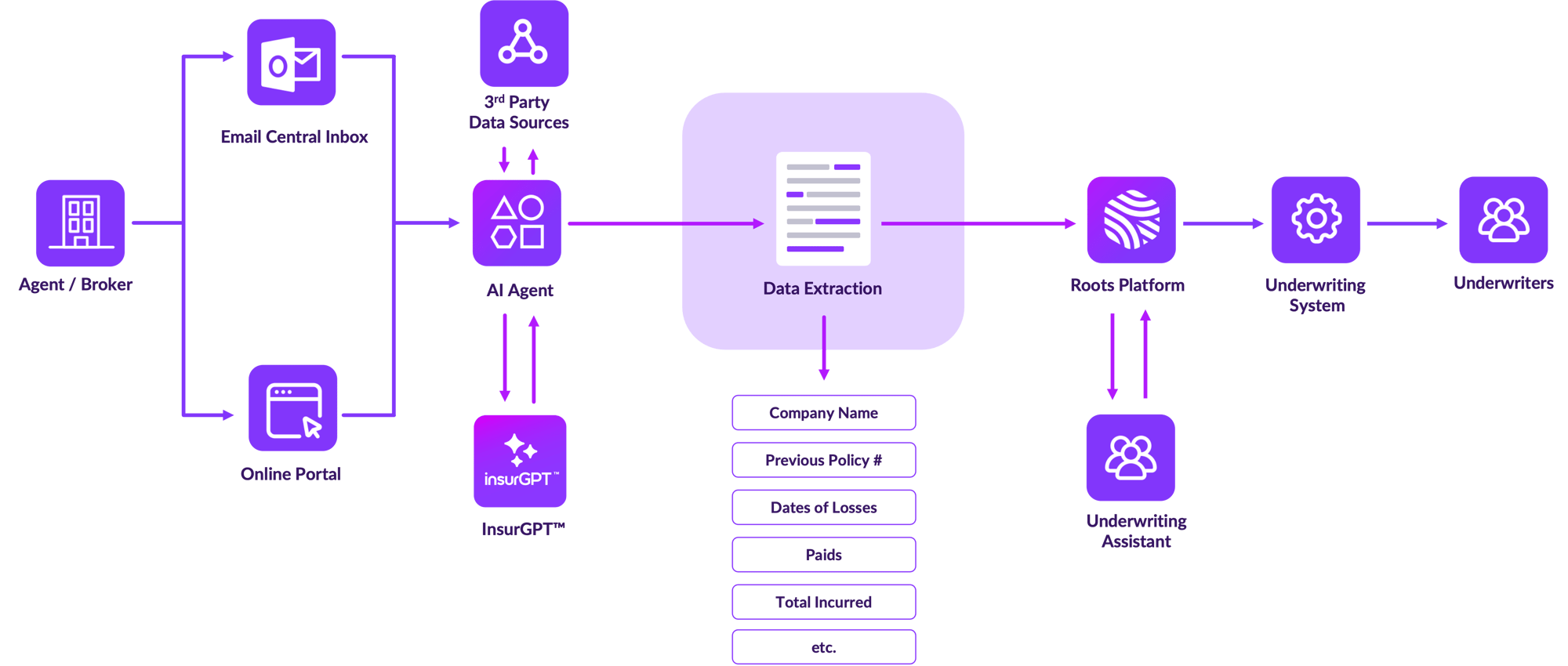

How It Works

Automated Loss Run Processing Explained

Automated Classification

New loss runs are automatically identified as part of the submissions intake process and separated from larger documents

Standalone Files

Automated monitoring of a document repository identifies individual loss run files for processing

Loss Run Data Extract

The Loss Run AI Agent identifies and extracts over 20 standard loss run data points including:

- Policy Number

- Policy Period

- Claim Number

- Date of Loss

- Date of Report

- Description of Loss

- Claim Status

- Paids

- Reserves

- Total Incurred

Augment with 3rd Party Data

Loss run data can be augmented with data from third parties and in-house systems to support risk assessment activities

Data Input

Loss run data automatically added to appropriate quoting systems

Underwriter Notification

Notifies the underwriting team that a loss run is ready for review

BENEFITS

Eliminate Submissions Backlog & Automate Loss Run Processing with Roots

- Process loss run reports 90% faster at 98% accuracy.

- Reduce quote times and smooth demand peaks by automating data extraction from loss run documents.

- Expand underwriting and clearance team capacity without increasing staff.

- Reduce external cost reliance on BPOs and gain greater control over your processes and data.

Ready to get started?

Schedule a personalized solution demonstration to see how Roots can improve your operations.