When it comes to acquiring business, insurance operates like many other businesses. Carriers develop products to stand out in a competitive market, sometimes carving out niche offerings. Independent agents and brokers shop across multiple carriers to secure the best coverage and pricing for their clients. Some even cultivate close relationships with underwriters, creating mutually beneficial dynamics.

An insurance book of business transfer – sometimes called an insurance book transfer (or book transfer for short) – is an opportunity to enter new markets or expand a carrier’s presence within specific lines or markets. Using AI creates many ways to help insurers maximize value from book transfers while minimizing business disruption.

What Are Insurance Book Transfers and Why Do They Happen?

A book of business transfer refers to the movement of a block of policies, sometimes hundreds or even thousands, from one carrier to another. These can occur voluntarily when agents seek better pricing or broader coverage. In other cases, they are involuntary due to a carrier exiting a market or ending a relationship. Book transfers can also be program-specific, due to the movement of a specialized book of business (e.g., contractors or hospitality accounts) as a unit.

For the receiving carrier, this represents a high-volume opportunity. For operations, however, it can quickly become a high-pressure project with the usual complications (i.e., tight deadlines, limited budgets, or other resources).

The motivations behind book transfers can vary. They could be the result of a carrier exiting a line of business, leaving brokers and agents to find new placements for their clients. Changes to a carrier’s underwriting appetite or coverage terms can also force brokers and agents to place clients with other insurers. Business consolidation affecting agencies or brokers, or poor performance may cause clients to terminate relationships. Or a broker might seek better service, more favorable pricing/rating, and broader product offerings for their clients.

Irrespective of the reason, the result is the same – a large volume of policies need to be reviewed, rewritten, repriced, and remarketed, and often within a short time span.

How Insurance Book Transfers Affect Stakeholders Across the Insurance Value Chain

Book transfers can be high-stakes/high-reward ventures with widely varying impacts. Here are some of the benefits and potential pitfalls to help assess an organization’s state of readiness to accommodate a large transfer of new business.

Creating or Sustaining Momentum for Agents and Brokers

When carriers limit or drop coverage, agents and brokers are left scrambling to preserve client relationships. And when carriers sever ties altogether, a broker has to find a new home for every affected policy. This is an exercise that goes beyond mere placement. An effective policy transfer requires matching coverage terms, deductible structures, endorsements, and pricing – and it needs to be scalable to work across dozens, hundreds, even thousands of policies. facilitate a book transfer, ensuring a smooth transition and minimizing client disruption.

Making New Customers Feel Welcome

Eventually, the success of a book transfer comes down to one factor: Did we deliver an outstanding customer experience? Mishandled book transfers can have an immediate business impact through loss of business from dissatisfied new policyholders looking for other options. And, of course, long-term reputational harm.

Operational Impact on the Receiving Carriers

For carriers, a book transfer may appear to be a strategic win. Instead of acquiring one policyholder at a time, the organization receives a significant volume of new business all at once. From a leadership standpoint, this can be viewed as a major growth milestone. However, with large-scale opportunities come monumental challenges to be solved on tight timelines, including matching coverages, aligning deductibles, and maintaining prices within a specific range. Typically, operations leaders are expected to execute book transfers with limited human and technological resources, or make a case for value/ROI before being given expanded resources.

Some common consequences from a poorly executed book transfer can include:

– Policyholder confusion regarding the new carrier or policy terms

– Frustration from having to reestablish billing or online account access

– Delays in service due to incomplete data or mismatched coverage

– Loss of trust or potential policyholder attrition

Effectuating a smooth, proactive book transfer creates relationship-building opportunities by reinforcing policyholder confidence and positioning the new carrier as an upgrade.

Why Insurance AI Is Key to Better Book Transfer Execution

In a pinch, operations leaders might turn a BPO vendor to execute a book transfer. This approach can build capacity in the short term – but often at the cost of adding complexity while reducing accuracy.

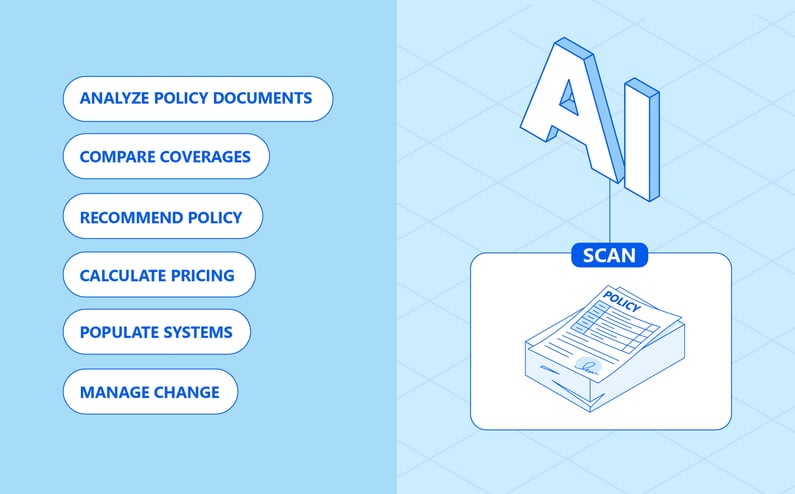

Typically, the more efficient and effective solution is deploying AI to process large tranches of new business documents. AI is gaining momentum in our industry for its adaptability across a wide range of function areas. Carriers have demonstrated AI’s capabilities to:

- Ingest and analyze legacy policy documents

- Compare prior coverages to current products

- Identify specific missing exclusion clauses

- Recommend equivalent policy structures

- Calculate appropriate pricing based on defined rating logic

- Populate systems to reduce manual data entry

- Manage change correspondence for new policyholders.

By embedding AI into your workflow, you can offload the heavy lifting involved in evaluating and reissuing transferred policies. This improves speed, consistency, and accuracy while easing the burden on internal teams.

Best Practices for Getting Maximum Strategic Value from Book Transfers with AI

When effectively planned and executed, a book transfer strengthens agent relationships, increases premium volume, while showcasing a carrier’s resilience and ability to scale efficiently. Successful book transfers are one outcome from having a cohesive, forward-thinking AI adoption and expansion playbook.

Proven insurance book transfer AI integration strategies include:

- Automate data cleanup and policy mapping

- Extract, compare, and validate documents for maximum accuracy

- Apply analytics to assess transfer readiness

- Predict client retention and renewal patterns

- Integrate AI to coordinate workflows and communication

Without the right resources and technology already in place, book transfers can overwhelm internal teams and negatively impact the customers you’re introducing to your brand. By investing in the right AI partnership, carriers will have the scalability and support to turn a daunting operational challenge into a strategic advantage.

Ready to accelerate your business? Download our Insurance AI Implementation Checklist to shorten the time to value of your AI investment.