In the property and casualty (P&C) insurance industry, investments in AI are often evaluated using traditional cost-benefit methods that emphasize upfront pricing, projected savings, return on investment (ROI), and payback timelines.

While these metrics are useful, they often fail to capture the full scope of what it truly takes to adopt and sustain AI capabilities. One critical concept that is frequently overlooked is total cost of ownership (TCO). TCO is a financial framework that includes all direct and indirect costs associated with acquiring, implementing, operating, and maintaining AI solutions over their full lifecycle.

Whether the decision is to build a custom AI system, purchase a vendor platform, or delay implementation, it is essential to understand the long-term financial and operational impact. In an industry where speed, accuracy, service, and availability are essential, overlooking the full cost of ownership can lead to missed opportunities, inefficiencies, or even failed initiatives. TCO offers insurers a more complete lens through which to evaluate AI investments and make informed, future-ready decisions.

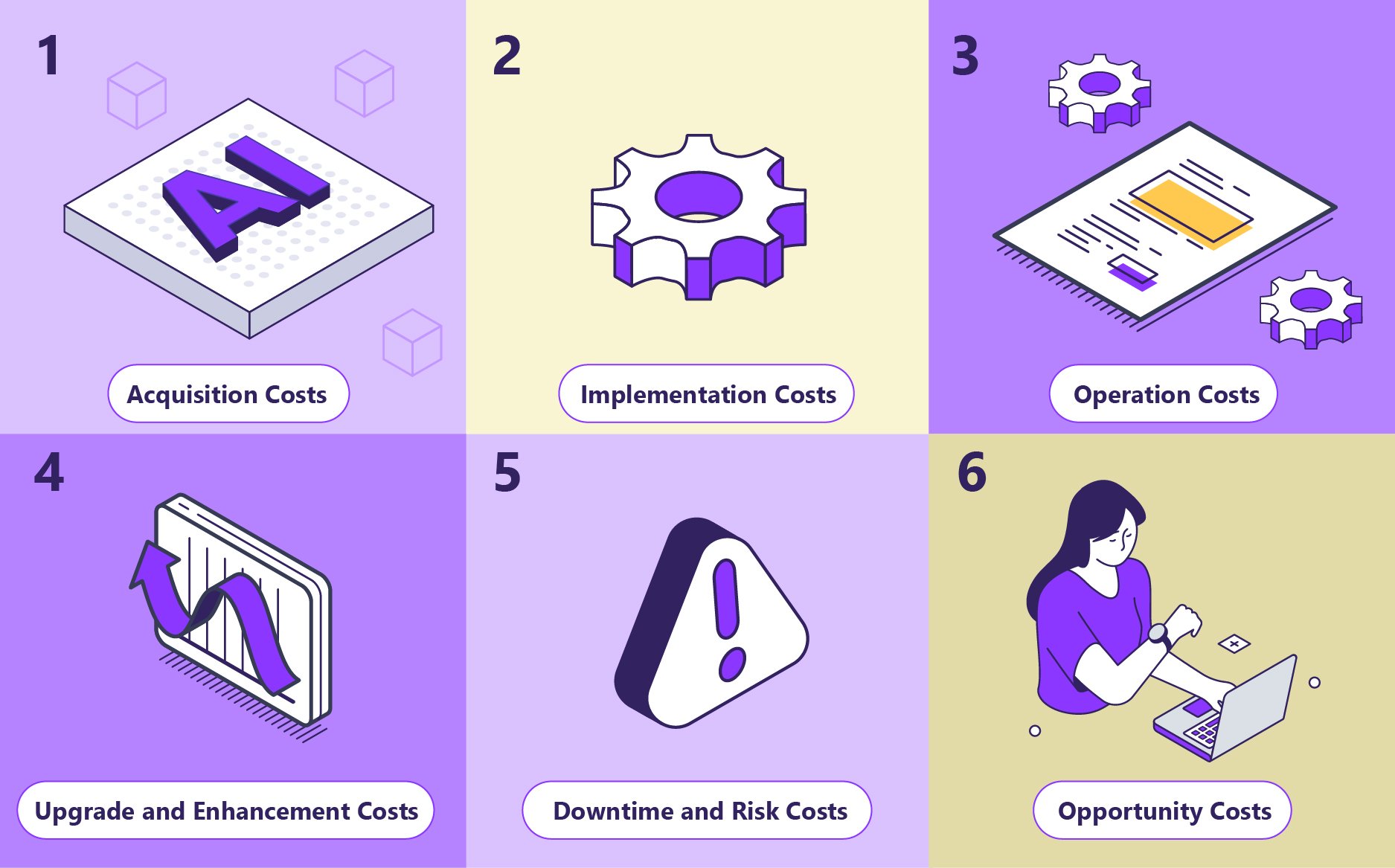

Key Components of TCO for Insurance Systems

For insurers, accurately calculating TCO affects the ability to make informed decisions, optimize budgets, and ensure technology investments deliver measurable value across underwriting, claims, and operations. The key components of TCO include:

1. ACQUISITION COSTS - These are the upfront costs required to bring an AI or insurance system into the organization. They include licensing or subscription fees, infrastructure and hosting setup, supporting software, and any initial development or customization needed to align with underwriting, claims, or policy workflows.

2. IMPLEMENTATION COSTS - Once acquired, the system must be deployed and integrated into existing platforms like policy administration, claims, or CRM systems. This stage also covers training employees, preparing data, and managing organizational change to ensure adoption across underwriters, adjusters, and service staff.

3. OPERATING COSTS - Ongoing expenses ensure the system continues to run smoothly and deliver value. This includes user support, monitoring, compliance oversight, and routine maintenance to handle model drift, evolving regulations, and day-to-day system performance.

4. UPGRADE AND ENHANCEMENT COSTS - Insurance systems require updates to remain effective and compliant as business needs change. These costs include version upgrades, adding new functionality, and scaling capacity to meet higher submission volumes, regulatory changes, or new product lines.

5. DOWNTIME AND RISK COSTS - Unplanned outages, system errors, or compliance gaps can create significant costs. Beyond financial losses, downtime can delay policy issuance, slow claims handling, or expose the carrier to regulatory penalties and reputational damage.

6. OPPORTUNITY COSTS - Keeping staff tied up with outdated systems or manual tasks means missed opportunities. The hidden cost is lost productivity and slower customer service, when resources could instead be focused on strategic underwriting, faster claims decisions, or improved broker and agent relationships.

Calculating TCO: Putting the Full Picture Together

When evaluating an AI solution for insurance operations, consider the full financial impact across the expected lifecycle of the technology. A structured TCO analysis brings clarity by accounting for the six core categories previously mentioned above.

TCO = Acquisition + Implementation + Operating + Upgrade/Enhancement + Downtime/Risk + Opportunity Costs

Each of these categories involves unique financial and operational considerations. By identifying and quantifying them early, insurers can better understand the long-term investment required, rather than relying solely on the initial price tag.

A seemingly low-cost AI platform may ultimately result in higher expenses if it requires extensive maintenance, lacks integration readiness, or struggles to meet performance expectations. In contrast, a more robust AI system with a higher upfront cost could deliver long-term value through improved automation, scalability, and reliability.

This level of analysis is critical in the current insurance environment, where cost efficiency must be balanced with innovation and regulatory pressure. An AI solution with a lower overall TCO allows insurers to free up resources for digital transformation, enhanced customer experiences, or the development of new products. It also supports operational resilience, a key priority for both regulators and policyholders.

Evaluating TCO is more than a financial checkpoint – it is a strategic discipline that ensures insurers choose AI solutions aligned with long-term growth, agility, and enterprise value. Too often, organizations see a low upfront cost and assume it will translate into a high ROI. But without factoring in hidden expenses such as usage fees, model retraining, integration, and ongoing staff support, the actual ROI can fall far short of expectations. By conducting a thorough TCO analysis first, insurers gain a clearer picture of the true financial commitment, avoid costly surprises, and position themselves to achieve sustainable returns from their AI investments.

Building for the Future: How TCO Shapes Sustainable AI Strategy

In the fast-moving landscape of insurance, short-term savings can be appealing, but it is the long-term costs that ultimately define real value. While ROI metrics and initial financials are important for budgeting and stakeholder approval, they only offer a partial picture. A comprehensive TCO analysis provides a deeper understanding by capturing the full spectrum of costs over the life of an AI solution.

For insurers exploring AI, this structured evaluation helps compare build, buy, or wait-and-see options on an equal footing. It brings clarity to the hidden costs and long-term implications that may not surface during initial evaluations. More importantly, it supports smarter and more strategic decisions that consider not just what the technology does today, but how well it will serve the business in the future.

Every AI investment comes with trade-offs. Insurers that use TCO as a guiding metric are better positioned to minimize surprises, maximize value, and ensure their AI initiatives support sustainable growth, resilience, and competitive advantage.

Learn more about building your own AI vs. buying through an AI solution provider by reading our infographic on Build vs. Buy: Understanding the True Cost of AI in Insurance.