QUANTIFYING VALUE

Insurance AI Benchmark Results

Not all AI models are created equal. This is especially true when working on complex enterprise insurance use cases. While general LLMs offer broad capabilities, purpose-built models like InsurGPT deliver unparalleled precision for underwriting and claims activities. Benchmarking is crucial: it's how we rigorously compare these distinct AI types to quantify potential ROI, ensuring your chosen AI partner substantially increases accuracy and minimizes your rework.

Roots Delivers The Highest Accuracy

For common insurance activities like document classification and data extraction Roots delivers more accurate outputs than LLMs.

Roots scored 99% for claims accuracy Mistral AI reached 62%

Roots scored 93% for underwriting accuracy GPT 4.1 only 67%

Roots scored 93% for underwriting accuracy Gemini 2.5 Flash got 83%

Built by Insurance Experts, for Insurance Experts

InsurGPT™ is the generative AI model built by insurance operators, for insurance operators. Trained on millions of insurance-specific data points, it understands the unique language and complexities of the insurance industry. Experience AI tailored to solve your challenges, delivering accuracy and intelligent automation like never before.

Roots Outperforms General Knowledge LLMs

98%+ Accuracy Guaranteed

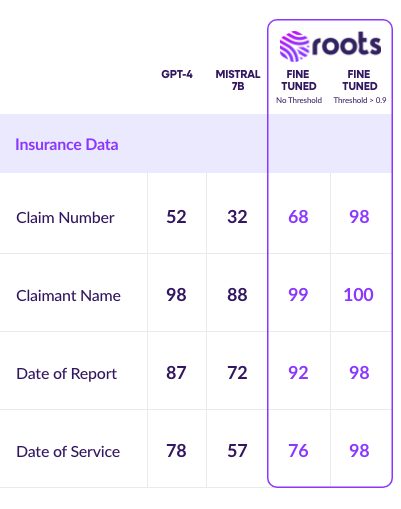

Claims Extraction Benchmark Results

Roots AI models top OpenAI and Mistral for accuracy across all key insurance fields, showing a considerable advantage with a confidence threshold.

Underwriting Extraction Benchmark Results

Roots AI models outperform state-of-the-art GPT, Gemini, and Deepseek models across key underwriting extraction fields.

Loss Run Extraction Benchmark Results

Roots AI models beat commonly used frontier, state-of-the-art models across key loss run insurance data extraction fields.

For common insurance activities like document classification and data extraction Roots delivers more accurate outputs than LLMs.

Our model has achieved 85% straight-through processing rates in production using a 90% confidence threshold.

How InsurGPT™ Works

Advanced AI-Powered Automation

InsurGPT™ powers the Roots Platform, driving AI Agents that automate complex processes involving both structured and unstructured data. This increases data accuracy to reduce errors and improve team capacity by learning from every human interaction.

98%+ Accuracy

Unlike generic AI models, InsurGPT™ is fine-tuned for insurance. It interprets documents and data with over 98% accuracy across most use cases. This includes understanding complex insurance documents, such as tables, checkboxes, and intricate forms.

Document Intelligence

InsurGPT™ is built with an advanced understanding of unstructured insurance documents, making it capable of reading and processing documents just like a human would.

Ensemble AI Model

InsurGPT™ uses a “best of breed” approach, selecting the most suitable AI methods for specific tasks, that delivers highly accurate and cost-effective AI outcomes tailored specifically for the insurance document and task needed at that moment.

Managed for AI Model Drift

Roots delivers an evergreen insurance AI model, InsurGPT™, that is continuously managed for drift, bias, and transparency, ensuring consistent, reliable performance.

Turnkey Models Improve ‘Zeroshot’ Accuracy

Roots’ approach to AI model curation provides continuously updated turnkey models that enhance zero-shot accuracy, minimize fine-tuning needs and significantly reduce operating and hosting costs.

Federated Learning

Root’s federated learning approach allows all insurers to benefit from platform-wide document interactions, improving overall accuracy intelligence and performance while protecting customer specific data.

Key Features of InsurGPT™

Benefits of Leveraging InsurGPT™

Automate & Transform Insurance Processes

InsurGPT™ lets insurers automate traditionally manual tasks, reducing operational friction, freeing up team resources, and allowing staff to focus more on customer engagement.

Increase Efficiency & Lower Risk

By enabling faster, more accurate quotes and reducing the risk of claims leakage, InsurGPT™ enhances your revenue potential while minimizing operational risks.

Scalable & Secure

InsurGPT™ delivers AI-driven automation that scales with your business, ensuring that data is handled securely and accurately at every step.

REAL RESULTS

Empower Your Insurance Operations

TRUST CENTER

Secure & Compliant

Roots meets ISO 27001, SOC 2 Type 2, HIPAA and CCPA compliance requirements.

Building AI Responsibly

At Roots, our singular focus is supporting insurance companies in delivering on their customer promises while keeping the trust and security of our AI at the forefront of everything we do.